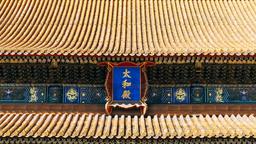

KraneShares Bosera MSCI China A Share ETF (KBA)

$30.88

Quotes are delayed by 15 minutes.

1D

1W

1M

3M

6M

YTD

1Y

2Y

5Y

ALL

Key data on KBA

AUM

$192987308

P/E ratio

87.8

Dividend yield

1.5408%

Expense ratio

0.56%

Beta

0.257176

Price on KBA

Previous close

$30.92

Today's open

$30.92

Day's range

$30.85 - $31.11

52 week range

$20.71 - $31.94

Popular funds like KBA

KBA industries and sectors

Equities

Foreign

China

Top holdings in KBA

601899:SH

Zijin Mining Group Co Ltd

7.48%

7.27%

News on KBA

Potential Opportunity In Chinese Markets As Trade Tensions With U.S. Cool

Easing tensions between China and the U.S. may be supportive of markets. Still uncertainty amid plans for Trump to visit China in 2026.

Seeking Alpha • Nov 7, 2025

China's Flow-Driven Equity Rally May Have Further Upside

Despite mounting macro headwinds at the start of the year, Chinese equities have continued to deliver positive performance. While near-term flows can provide further upside, the durability for the equity rally will hinge on policy choices ahead.

Seeking Alpha • Oct 4, 2025

APAC Equities: The Sensitivity To Oil Prices

Among APAC equity markets, Australia has a higher beta to oil prices while India, Indonesia and Thailand have lower betas. Domestic political uncertainties have been one main reason for the decoupling trend seen in Indonesia and Thailand.

Seeking Alpha • Jul 29, 2025

Could China Stop Exporting Deflation?

China plans to curb low-price competition and phase out outdated industrial capacity, targeting sectors like EVs, solar, and e-commerce. Reducing overcapacity could boost Chinese companies' profitability and attract more domestic and foreign investment into Mainland equities. Effective action on overcapacity may ease US-China trade tensions, potentially serving as a win-win in ongoing negotiations.

Seeking Alpha • Jul 24, 2025

Why Chinese Equities Are Outperforming Wall Street

Has the AI trade moved to China? Why Chinese chipmakers may soon change the semiconductor space.

Seeking Alpha • Mar 15, 2025

Hang Seng Index: Transforming Into A Medium-Term Bearish Trend Despite Improving Services PMI From China

Sentiment remains fragile in China and Hong Kong stock market even China services activities have improved in December. Weak market breadth and a persistent bearish trend of the Chinese yuan since November has added to more woes to the Hang Seng Index.

Seeking Alpha • Jan 8, 2025

China's Politburo Stance Reflects Significant Policy Shift

Statements made by China's Politburo after mainland market closures mark a tonal shift in policy mandates from the government. The statements lifted the Hong Kong market and reflect missed opportunities for investors currently underweight China.

ETF Trends • Dec 9, 2024

November PMIs, Real Estate, Car Sales Lift China Markets

China markets responded favorably to November's purchasing managers indexes gains alongside positive real estate and auto sales for the month. Investors currently underweight to the country may miss opportunities within domestic markets as policy support continues.

ETF Trends • Dec 2, 2024

KraneShares Gauges Domestic Investor Sentiment in China

Xiabing Su, cultural analyst at KraneShares, interviewed a variety of Chinese investors last month when visiting a brokerage firm in Lanzhou, China. While investors expressed a range of opinions regarding market outlooks, all demonstrated a depth of knowledge about the government's policy supports of markets.

ETF Trends • Nov 18, 2024

Where The Money Is Flowing In ETFs After China's Stimulus Package

China's stimulus plan head lead to big fund flows in ETFs. The trend towards private asset ETFs continues to gain steam.

Seeking Alpha • Oct 28, 2024

¹ Disclosures

Invest in KraneShares Bosera MSCI China A Share ETF

Open an M1 investment account to buy and sell KraneShares Bosera MSCI China A Share ETF commission-free¹. Build wealth for the long term using automated trading and transfers.