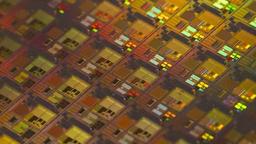

VanEck Vectors Semiconductor ETF (SMH)

$412.88

Quotes are delayed by 15 minutes.

1D

1W

1M

3M

6M

YTD

1Y

2Y

5Y

ALL

Key data on SMH

AUM

$46.26B

P/E ratio

35.1

Dividend yield

0.274%

Expense ratio

0.35%

Beta

1.540561

Price on SMH

Previous close

$415.03

Today's open

$413.57

Day's range

$409.28 - $417.70

52 week range

$170.11 - $420.60

Profile about SMH

Headquarters

US

Exchange

NASDAQ Global Market

Issue type

Exchange-Traded Fund

Popular funds like SMH

SMH industries and sectors

Industries

Technology

Top holdings in SMH

21.05%

10.47%

News on SMH

As Tech Stocks Churn, Nvidia and Other Semiconductor Plays Look Cheap

Fears of an AI bubble are sparking tech selloffs. That's changing the calculus for once-pricy semiconductor stocks, Morningstar analysts say.

Morningstar • Feb 19, 2026

AI Disruption Hit Multiple Sector ETFs: Is the Fear Overblown?

Artificial intelligence (AI) has emerged as a growing source of market panic these days, with investors increasingly questioning the long-term viability of labor-intensive business models. Recent releases from AI startups have intensified these concerns by introducing tools capable of automating tasks in legal, marketing, finance, and research functions.

Zacks Investment Research • Feb 12, 2026

Interested in Artificial Intelligence (AI) Stocks in 2026? Consider Buying This Top-Performing AI ETF.

An exchange-traded fund (ETF) can be a less risky way to gain exposure to artificial intelligence (AI) than buying individual stocks. VanEck Semiconductor ETF has a great track record over the short and long terms.

The Motley Fool • Feb 11, 2026

3 Thematic ETFs for the AI Revolution

Artificial intelligence has been one of the most impactful technologies released, and it's only getting better.

24/7 Wall Street • Feb 11, 2026

1 Tech ETF to Buy Hand Over Fist and 1 to Avoid

There are scores of tech ETFs to consider, but their performances aren't uniform. First Trust Cloud Computing ETF's software-oriened stocks are taking a drubbing.

The Motley Fool • Feb 11, 2026

A Top Semiconductor ETF Ran 62% Despite Top Holding Slashing Dividend by 75%

The VanEck Semiconductor ETF (NYSEARCA:SMH) manages $44.1 billion in assets but delivers a minimal 0.24% yield.

24/7 Wall Street • Feb 10, 2026

Why VanEck Semiconductor ETF -- the Best AI ETF, in My View -- Gained 12% in January

Micron stock -- the ETF's No. 4 holding -- soared 45.4% in January.

The Motley Fool • Feb 9, 2026

How A 2X Leveraged AI Server ETF Gained 20% in Minutes

When a single-stock leveraged ETF launches, it's either a gift to speculators or a trap for the unwary.

24/7 Wall Street • Feb 8, 2026

Don't Know Which AI Stock To Buy? Here's the Easiest Way To Play the Once-in-a-Generation Tech Boom.

If you're looking for exposure to AI stocks, the best place to look is in semiconductors. Demand for semiconductors should continue to grow even without AI.

The Motley Fool • Feb 4, 2026

Can Generative AI Drive These 3 ETFs to 43% Gains This Year?

The VanEck Semiconductor ETF has heavy exposure to Nvidia and Taiwan Semiconductor. For equal-weight exposure, the State Street SPDR S&P Semiconductor ETF is a good option.

The Motley Fool • Jan 23, 2026

¹ Disclosures

Invest in VanEck Vectors Semiconductor ETF

Open an M1 investment account to buy and sell VanEck Vectors Semiconductor ETF commission-free¹. Build wealth for the long term using automated trading and transfers.